CBAM regulation, the border carbon adjustment mechanism

Despite EU's awareness of climate change, many companies have so far managed to evade its strict policies by moving their production to other countries outside the EU. Also in order to cut costs, many EU products have been replaced with imports from other countries with laxer legislation. This phenomenon is known as "carbon leakage".

With the entry into force of the new CBAM (Carbon Border Adjustment Mechanism) regulation, the aim is to put a fair price on the carbon emitted during the production of goods entering the EU.

How does the CBAM work?

CBAM works as a system of certificates to declare a price on the carbon emissions emitted by the products that are imported into the EU. National authorities in each EU country authorise registrations in their CBAM system, including verification of review and declaration.

They also have the power to sell CBAM certificates to importers. The price of the certificates is calculated based on the average weekly auction price of EU ETS allowances expressed in €/tonne of CO2 emitted.

This system ensures that the carbon price of imports is equivalent to the carbon price of domestic production. It is also compatible with EU climate targets and UN rules.

Who is affected by CBAM?

CBAM mainly applies to carbon-intensive material imports: cement, iron and steel, aluminium, fertilisers, electricity and hydrogen.

CBAM entry into force

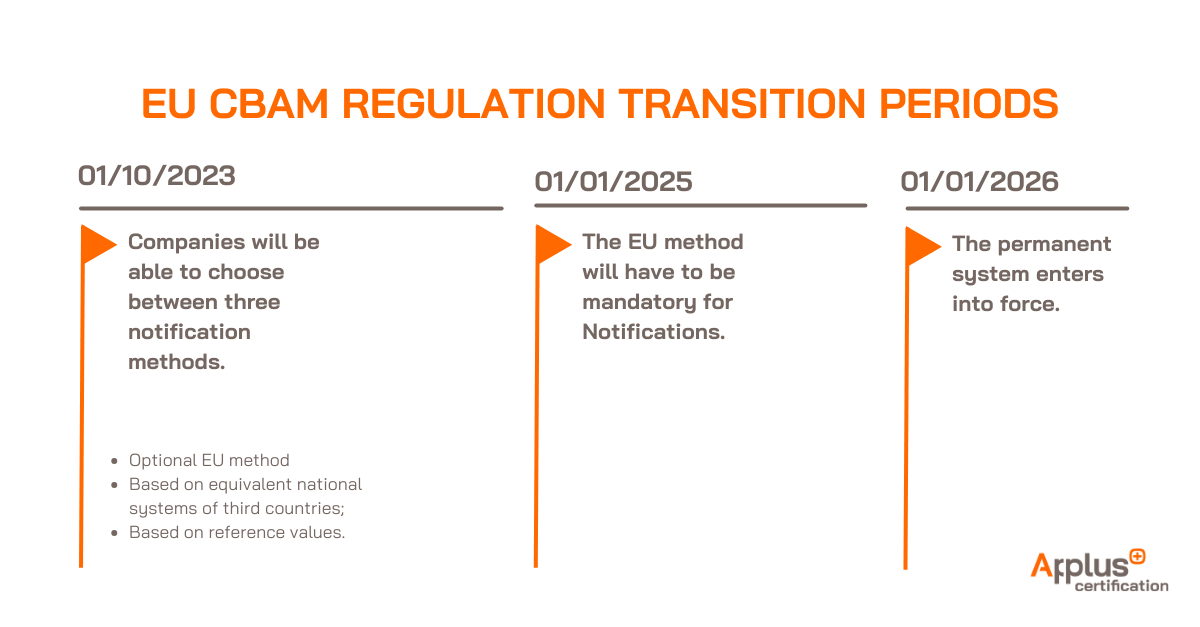

From 1 October to 31 December 2024, the CBAM regulation will be applied on a transitional and gradual basis. During the first year of implementation, companies will be able to choose between three modes of quarterly reporting:

- Full notification under the new methodology (EU method).

- Reporting based on equivalent national systems in third countries.

- Notification based on reference values.

A platform for deferred reporting has been made available for those reporters who have not been able to report before 31 January for technical reasons.

However, from 1 January 2025, reporting will only be possible according to the mandatory EU method.

On 1 January 2026 the permanent system enters into force. From that date, importers that fall under CBAM’s product scope will have to report the quantity of goods they import each year into the EU and implied GHGs.

Therefore, from that date, importers will be required to:

- Receive authorizations as a CBAM declarant.

- Purchase CBAM certificates to cover the CO₂ emissions generated in the manufacture of the goods they import.

- Declare the quantity of imported CBAM goods (including embodied CO₂ emissions) by 31 May of the year following the import.

Applus+ Certification verifies emissions under the CBAM framework

The Applus+ Certification team is accredited to perform:

- The verification of implicit emissions within the CBAM framework.

- The verification of carbon footprints at national and international level.

In addition, we have carbon footprint monitoring and tracking software for the entire supply chain.